Generative AI is in full swing to revolutionize the services of the financial industry. The industry also needs this powerful technology as financial teams engage with an extensive amount of data daily. This makes the finance industry a natural fit for GenAI. Generative AI has the full capability to sift through diverse datasets and documents to help humans get original content and insights for educated decision-making.

McKinsey report says that GenAI is likely to generate a value between $200 and $340 bn in the banking industry. The finance industry is not on the sidelines of the generative AI revolution. It’s proactively embracing generative AI services and solutions across departments.

In this article, we have examined the top generative AI use cases in the financial industry and discussed the prevailing challenges that the industry and banks must address to achieve innovation and efficiency in operations.

Rise of GenAI in Finance and Banking Industry

GenAI is a cutting-edge form of artificial intelligence with the supreme capability to learn from available datasets and independently create responses. It can even analyze extreme volumes of financial data to identify trends and patterns for informed decision-making. On the other hand, RPA is a software technology to automate daily routine tasks such as document processing, data entry, etc.

The primary feature that gives GenAI an extra advantage is its learning and adaptive potential. Generative AI is among the few technologies that have the capability to process all types of historical financial data. Generative AI services in finance allows professionals to learn from historical data and make solid, educated decisions. However, RPA is only for task automation, which is already defined in the programming.

The Accenture report says that large language GenAI models can impact 90% of the working hours.

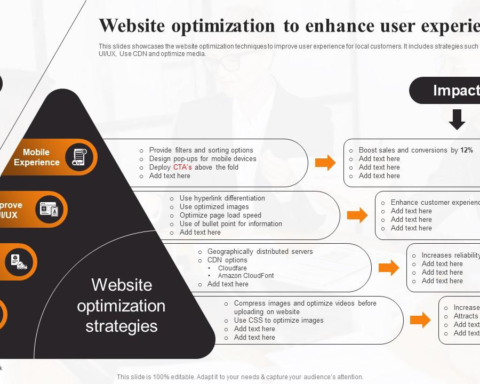

Generative AI Use Cases for the Financial Industry

The following are the top 5 generative AI applications in the financial industry:

Fraud Detection

Generative AI can significantly assist the financial industry in fraud detection by leveraging its potential to analyze anomalies in financial transactions. Its models learn from historical data to figure out behaviors that show fraudulent activity, enabling financial institutions to explore the future with AI finance automation.

The generative AI algorithms can interpret real-time transactions, find irregularities, and alert the team for further investigation. This assists financial institutions in preventing and reducing the impact of financial fraud and enhancing the firm’s security measures.

Personalized Customer Service

Customers want to connect with financial institutes and banks around the clock. It is not a surprise. Well, finance AI solutions like chatbots can help organizations in this regard.

Simulating a real-time enhances the financial services. AI chatbots utilize NLP technology to respond to customer queries. What does it mean? It means a lot of new clients, and personalized customer services for the current ones.

Algorithmic Trading Strategies

Algorithmic trading has reinvented the financial world. GenAI has taken this one step further by developing trading strategies on the basis of realistic market data. The GenAI algorithms have the ability to adapt to market conditions, which automatically optimizes portfolio performance and alleviates risks. Financial firms can employ GenAI to create AI trading strategies to enhance their trading efficiency.

If you think that these AI trading strategies are limited to traditional assets (like bonds and stocks), you’re wrong.

You can also apply it to cryptocurrencies and related alternative investments. The Gen AI algorithms have the full potential to figure out loopholes in the market and ensure trading at a greater speed. You, as a financial company, must collaborate with a generative AI services company to enhance the efficiency of your trading strategies.

This allows you to perform trading even with the smallest price brackets.

Market Sentiment Analysis

Market sentiment analysis by generative AI is gaining popularity in the financial industry. Generative AI processes and interprets large volumes of textual data from financial reports, news articles, and social media.

Whether the sentiment is negative, positive, or neutral, these models can recognize the sentiment in the data to measure the market’s sentiment trends. This information can help financial professionals and investors with valuable market insights and dynamics.

Investment Analysis

Generative AI in finance can also perform personalized investment analysis. The comparison it makes is better than manual investment analysis. Its algorithms process all sorts of available datasets that can influence investment decisions. It can actually synthesize diverse datasets containing financial statements, past performance, news events, regulatory changes, macroeconomic trends, and more.

This allows generative AI models to figure out complex insights that human resources would possibly miss.

Many financial organizations are employing these Gen AI algorithms to identify potential investment opportunities and optimize the overall stock selection. The Barclay Hedge survey reports that 56% of hedge fund experts say they use AI and ML to inform their investment mechanisms.

Key Generative AI Challenges in the Financial and Banking Sector

As generative AI is a new technology in the financial sector, it has a few limitations as well.

– Bias and fairness

– Information confidentiality

– Compliance with regulatory directives

– System implementation and change

The financial businesses must learn how to balance profits and risks to make the best use of generative AI services.

Why Financial Firms Must Become AI-first

You will see GenAI in a more powerful state in the coming years. The finance industry will be among industries that will incorporate GenAI the most into their business workflows. The organizations will be offering personalized services based on the customers’ wants and preferences.

So, as a reputed financial business, you must take one step further by welcoming generative AI development services. From personalized customer service to operational efficiency, generative AI technology will create a great number of opportunities for financial companies.

Stay in touch to get more updates & news on Essentialtribune!